If you need a new roof, you may wonder if your insurance will cover the replacement cost. After all, a new roof can be a significant expense, and it's important to know what options are available to you.

In this article, we'll explain how to determine if your insurance will cover the cost of a new roof and provide tips on how to get insurance to cover roof replacement.

First, it's important to understand that insurance policies vary, and not all policies will cover the cost of a new roof. However, in many cases, insurance will cover the cost of a new roof if a covered event damages it, such as a storm, fire, or vandalism.

If you're unsure if your policy covers roof replacement, reviewing your policy or contacting your insurance provider for clarification is best.

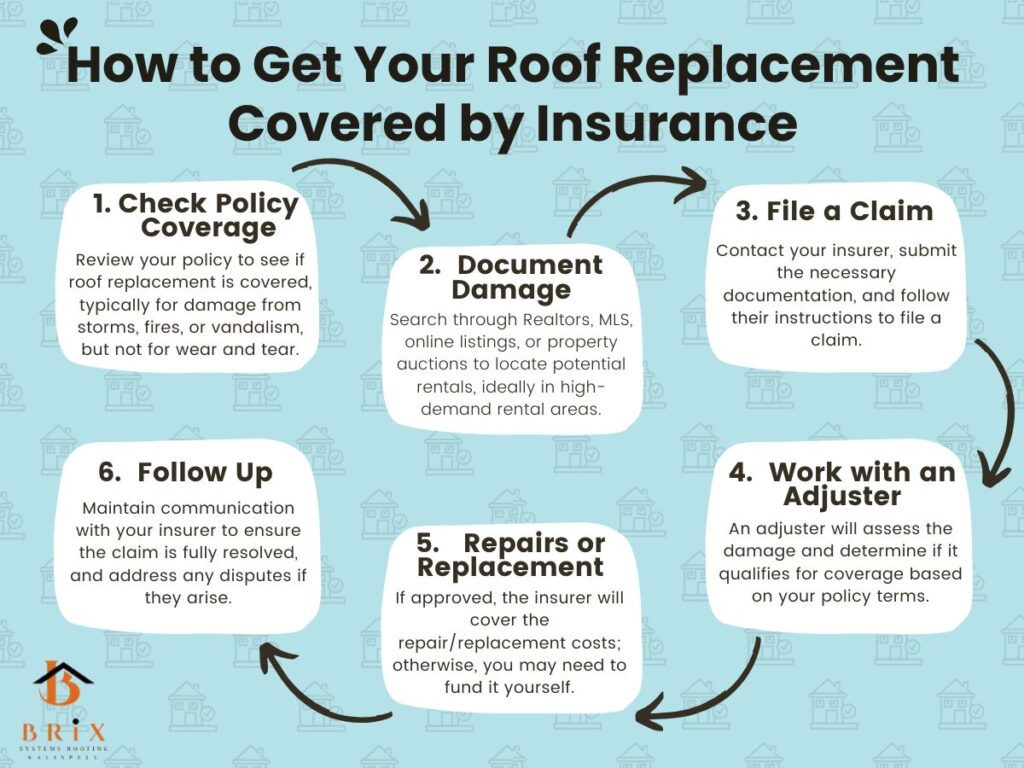

Before determining how to get insurance to cover roof replacement, it's important to understand what your insurance policy covers. Most homeowners' insurance policies cover damage to the roof caused by certain events, such as storms, fires, and vandalism. However, coverage for wear and tear or deterioration may be excluded.

To find out if your insurance policy covers roof replacement, you'll need to review the terms and conditions of your policy. Look for any language related to roof damage or replacement. You may also find it helpful to speak with an insurance agent or broker who can provide more information about your specific policy.

If you're unsure about the coverage included in your policy, you can also contact your insurance company directly to ask about coverage for roof replacement. The customer service representative should be able to provide more information about what is covered under your policy and whether you are eligible for coverage for roof replacement.

If you believe your roof may be eligible for coverage under your insurance policy, it's important to document the damage as thoroughly as possible. Make a list of the damage and how it occurred (e.g., storm damage, wear and tear, etc.). This will be essential when you file a claim with your insurance company.

To document the damage, take pictures of the affected areas of your roof. Be sure to get a wide shot showing the roof's overall condition and close-up shots of any specific damage. If you have any receipts or estimates for repairs, keep those. These documents can provide valuable information about the extent of the damage and the cost of repairs.

It's also helpful to list the damage and how it occurred. This can include details about the type of damage (e.g., missing shingles, leaks, etc.) and information about the event that caused the damage (e.g., storm, fire, etc.). This information will be important when you file a claim with your insurance company, as it will help them understand the circumstances surrounding the damage to your roof.

Once you have gathered all the necessary documentation, filing a claim with your insurance company is time. This process typically involves contacting the insurance company and providing them with information about the damage to your roof.

To file a claim, you'll need to have your insurance policy and the documentation you gathered about the damage to your roof. You may also need to provide receipts or estimates for repairs.

Once you have gathered all the necessary documentation, contact your insurance company and inform them of the damage to your roof. They will likely provide instructions for filing a claim, including completing a claim form or providing additional information. Follow these instructions carefully, as this will help ensure your claim is processed efficiently.

The insurance company will then determine if the damage is covered under your policy and the amount of coverage you are entitled to.

After you have filed a claim with your insurance company, they will typically send an adjuster to assess the damage to your roof. The adjuster will examine the roof and determine the extent of the damage, as well as the cost of repairs.

The adjuster will also review your insurance policy to determine if the damage is covered under your policy. They will consider the type of damage, the cause of the damage, and any exclusions or limitations outlined in your policy. Based on this information, the insurance company will determine whether you are eligible for coverage and the amount of coverage you are entitled to.

If your insurance policy covers the damage to your roof, the insurance company will typically pay for repairs or replacement. If the damage is not covered, you will need to pay out of pocket for the repairs or replacement.

If your insurance policy covers the damage to your roof, the insurance company will typically pay for repairs or replacement. This may include the cost of materials, labor, and other expenses associated with repairing or replacing your roof.

If the damage is not covered under your insurance policy, you will need to pay for the repairs or replacement out of pocket. This can be a significant financial burden, so it's important to consider your options and budget accordingly carefully.

After you have filed a claim with your insurance company and had your roof repaired or replaced, it's important to follow up with the insurance company to ensure that everything is resolved to your satisfaction. This may include keeping track of all communication and documentation related to your claim and addressing any issues or disputes that may arise.

If you have any issues or disputes with your insurance company, it's important to follow the appropriate steps to resolve them. This may include contacting the insurance company to discuss the issue or seeking the assistance of a mediator or legal professional.

Overall, getting insurance to cover roof replacement can be a complex process. Still, with the right approach and careful documentation, it is possible to secure coverage for this significant home repair. By understanding your insurance policy, documenting the damage to your roof, and working closely with your insurance company, you can get the assistance you need to repair or replace your roof and protect your home.

There are several things to consider when trying to get your insurance to cover a roof replacement.

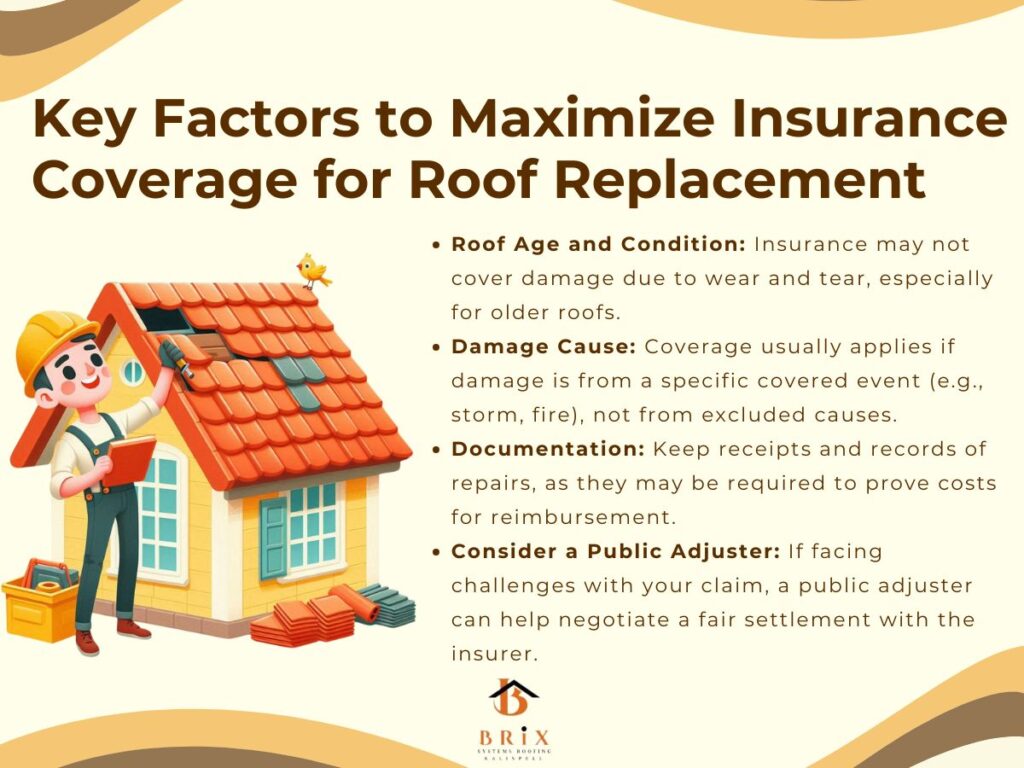

Insurance policies often have exclusions for damages that are considered normal wear and tear. If your roof is old or in poor condition, it may be more difficult to get your insurance to cover the replacement.

In order to be covered by insurance, the damage to your roof must typically be the result of a covered event, such as a storm or fire. If the damage was caused by something that is not covered by your insurance policy, it might be more difficult to get your insurance to pay for the replacement.

If you have receipts or other documentation related to the roof replacement, be sure to keep them in a safe place. These can be helpful if you need to provide proof of the cost of the repairs or replacement to your insurance company.

If you have difficulty getting your insurance company to cover the roof replacement cost, you may want to consider hiring a public adjuster. Public adjusters are trained professionals who can advocate on your behalf and help you get a fair settlement from your insurance company.

If you think your roof may need to be replaced in the near future, it's a good idea to start preparing for the process. This can help ensure that you have the resources and information you need to get the job done effectively and efficiently.

One of the first steps to take when preparing for a roof replacement is to set aside funds for a deductible. Most insurance policies require that you pay a deductible before the insurance company covers the cost of repairs or replacement. By setting aside money for a deductible, you'll be better prepared to cover this upfront cost if the need arises.

If your insurance company denies your claim for roof replacement, it's important to understand why. The insurance company should provide a reason for the denial, which may be related to the type of damage, the cause of the damage, or an exclusion or limitation in your policy.

Suppose you believe the denial was made in error or that you are entitled to coverage under your policy. In that case, you may appeal the decision or negotiate with the insurance company. This may involve providing additional documentation or information about the damage to your roof or working with a mediator to resolve the issue.

One way to help prevent the need for a roof replacement is to perform regular maintenance on your roof. This can help extend your roof's lifespan and save money on future repairs or replacements.

To keep your roof in good condition, it's important to clean your gutters regularly. Clogged gutters can cause water to build up on the roof, leading to leaks and other damage. Keeping your gutters clean can help prevent this type of damage.

It's also a good idea to inspect your roof for damage regularly. Look for missing shingles, leaks, or any other signs of damage. If you notice any issues, make small repairs to prevent further damage.

Your insurance company may be involved in the repair or replacement process in several ways. They may guide the type of materials to use, requiring that the work be performed with certain materials or by a certain contractor. This is often done to ensure that the work meets certain standards and will be covered under the policy in the future.

The insurance company may also require that the work be inspected before payment is made. This is typically done to ensure that the work has been completed to the required standards and that the repairs or replacement will effectively address the damage to your roof.

It's important to understand the insurance company's role in the repair or replacement process and follow their guidelines to ensure that your claim is processed smoothly. This may include providing any requested documentation or information and working with the insurance company's preferred materials. By following the insurance company's guidelines, you can help ensure that your claim is approved and that you receive the coverage you are entitled to under your policy.